Finance Minister Nirmala Sitharaman lists agriculture, MSMEs, investments, and exports as four key engines of development in the Union Budget 2025. Let’s understand how the Union Budget addresses these four engines of growth for Viksit Bharat.

In her speech, she highlighted four engines of development for the 2025-26 fiscal year: agriculture, micro, small, and medium enterprises (MSMEs), investments, and exports. “The fuel for this journey is provided by reforms, the guiding principle is inclusivity, and the destination is Viksit Bharat,” stated the Finance Minister. In this context, understanding the highlighted engines of growth is crucial.

What is the Union Budget?

The Union Budget (called the Annual Financial Statement under Article 112 of the Constitution of India) provides an account of the government’s financial health. It shows details about a government’s finances by providing the estimated receipts and expenditures of the Government of India for the current financial year, along with revised estimates for the last financial year and actuals for the last to last financial year.

The Budget

It is called the Annual Financial Statement, which is a statement of accounts of the Government. Article 112 (for the central government) and Article 202 (for the state government) provides for the annual financial statement to be laid before the respective legislatures. Since the Budget reflects the Government’s vision and its policies to come in future, it becomes one of the most important annual events for the Indian Polity.

Simply put, a Budget is a process or an exercise through which the government informs Parliament (and by extension, the entire country) about the state of its finances. Transparency about three key areas are expected in a budget: income, expenditure, and borrowing.

“since a Budget typically comes at the end of one financial year and the start of another, it tells the citizens not only how much money the government raised last year, where did it spend it, and how much did it have to borrow to meet the gap but also gives an estimate about what it expects to earn in the next financial year (in the present case, the current financial year), how much and where it plans to spend it, and how much would it likely have to borrow to bridge the gap.”

The Budget division comes under the Department of Economic Affairs of Finance Ministry of Government of India. The budget is caused to be presented before both the houses of the Parliament by the President. It is presented by the Finance Minister. The Budget speech consists of two parts. Part A consists of overview of the economy and highlights the concerns and priorities of the government- flagship schemes and major programmes . Part B of the speech deals with tax proposals in the Budget.

Along with Budget Speech and Annual Financial Statements, the following documents are submitted: Demands for Grants, Finance Bill, Statement mandated under FRBM Act, Expenditure Budget, Receipt Budget, Statement of Revenue forgone, Expenditure Profile, Budget at a Glance, Memorandum Explaining the Provisions of Finance Bill and Outcome Budget.

For Your Information

The Railway Budget was separated from the General Budget in 1924 based on the Acworth Committee’s (1920-21) recommendation. It was merged with the General Budget in 2017-18 on the recommendation of the Bibek Debroy Committee.

Which one of the following statements appropriately describes the “fiscal stimulus”?

(a) It is a massive investment by the Government in manufacturing sector to ensure the supply of goods to meet the demand surge caused by rapid economic growth

(b) It is an intense affirmative action of the Government to boost economic activity in the country

(c) It is Government’s intensive action on financial institutions to ensure disbursement of loans to agriculture and allied sectors to promote greater food production and contain food inflation

(d) It is an extreme affirmative action by the Government to pursue its policy of financial, inclusion

Which one of the following statements appropriately describes the “fiscal stimulus”?

(a) It is a massive investment by the Government in manufacturing sector to ensure the supply of goods to meet the demand surge caused by rapid economic growth

(b) It is an intense affirmative action of the Government to boost economic activity in the country

(c) It is Government’s intensive action on financial institutions to ensure disbursement of loans to agriculture and allied sectors to promote greater food production and contain food inflation

(d) It is an extreme affirmative action by the Government to pursue its policy of financial, inclusion

The Funds

The General Budget contains estimated receipts and expenditure for one year usually. The three funds which are important in this regard are:

Consolidated Fund of India:All revenues received, loans raised and all money received by the Government in repayment of loans are credited to the Consolidated Fund of India and all expenditures of the Government are incurred from this fund. Money can be spent through this fund only if appropriated by the Parliament. The consolidated Fund has further been divided into ‘Revenue’ and ‘Capital’ divisions. It has been defined in Article 266 (1) of the Constitution.

Public Account of India: It is established under Article 266(2) of the Constitution. All public money received, except those included in the Consolidated Fund of India, is held in this account. It primarily consists of funds raised through small savings schemes, provident fund schemes, and similar sources. The government acts merely as a custodian and is obligated to repay the amounts either on the maturity date or whenever claimed by the rightful individuals.

Contingency Fund of India: It is established under Article 267 of the Constitution to address unforeseen expenditures. It is maintained at the disposal of the President of India, allowing for immediate disbursement of funds when necessary. The expenditure incurred can be met promptly, with parliamentary approval obtained retrospectively.

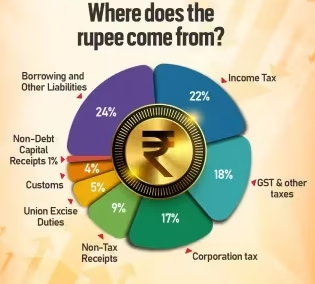

The Receipts

There are two types of receipts:

Revenue Receipts: These are receipts that do not need to be repaid to the payee by the government and include income generated from government assets. Essentially, these are one-way transactions. Revenue receipts primarily consist of tax revenues, non-tax revenues, and other non-tax receipts.

Capital Receipts: These receipts involve two-way transactions. Once disbursed, the money either generates regular income or is recovered when an asset created from the disbursed funds is disposed of. Capital receipts arise from the disposal of permanent assets, the recovery of loans extended to others, and the raising of new loans by the government. They are further classified into two categories: Debt Capital Receipts (such as borrowings and other liabilities) and Non-Debt Capital Receipts.

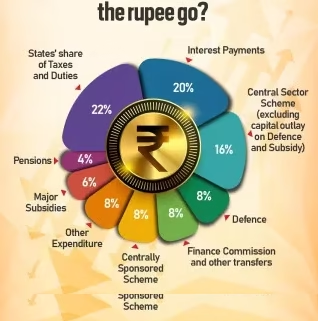

The Expenditures

Public expenditures can be classified into two categories:

1. Revenue Expenditure: This refers to expenses incurred to meet the day-to-day operational and administrative needs of the government, which do not generate revenue in the future. It is a one-way expenditure, meaning once the government spends the amount, it cannot be recovered.

2. Capital Expenditure: This includes expenses that create permanent assets and generate periodic income. It also covers loans provided to state governments and local bodies. Capital expenditure is considered a two-way payment since the money spent can be recovered either through periodic income or by selling the created asset.

With reference to the expenditure made by an organization or a company, which of the following statements is/are correct?

- Acquiring new technology is capital expenditure.

- Debt financing is considered capital expenditure, while equity financing is considered revenue expenditure.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

With reference to the expenditure made by an organization or a company, which of the following statements is/are correct?

- Acquiring new technology is capital expenditure.

- Debt financing is considered capital expenditure, while equity financing is considered revenue expenditure.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

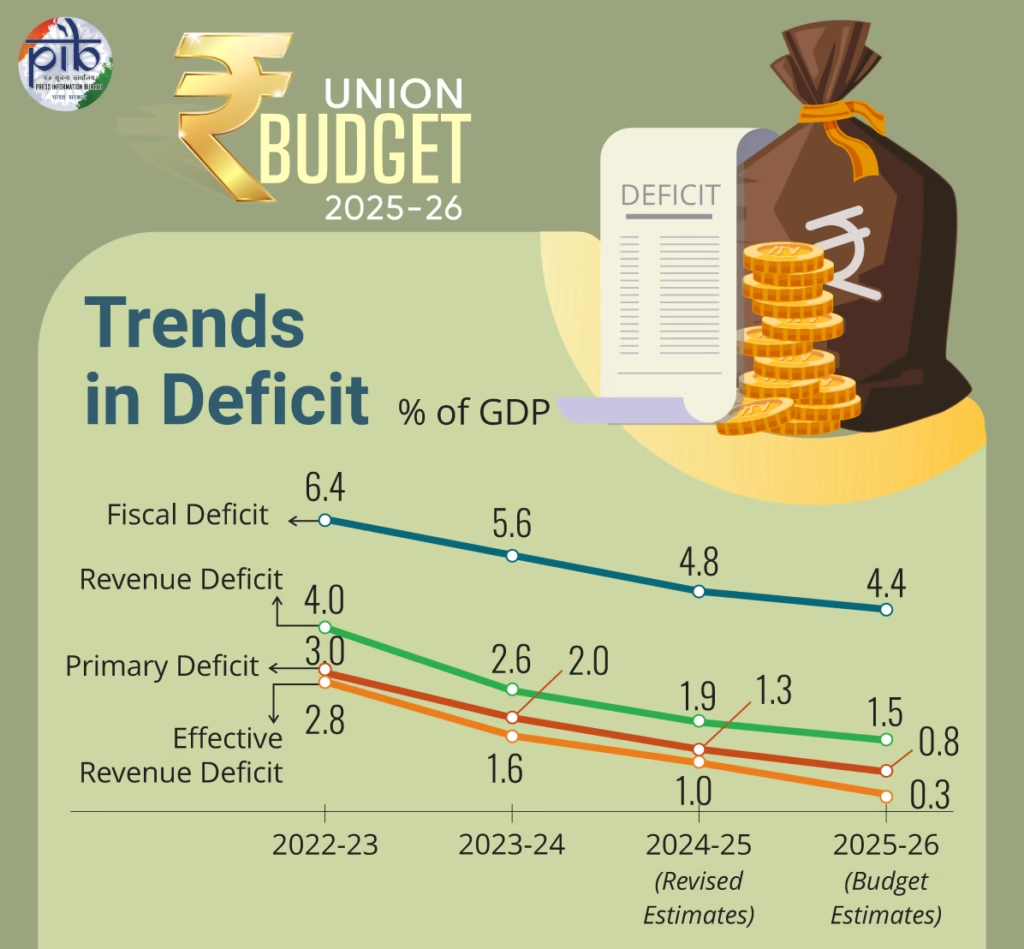

The Deficits

The gap between the receipts and expenditure is called deficit. So, it is a shortage of money for expenditure. Here are some deficits you must know.

Budget Deficit = Total Expenditure – Total Receipts

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Effective Revenue Deficit = Revenue Deficit – Grant in aid for creation of capital assets

Fiscal Deficit = Total Expenditure – Total Receipts except Borrowing and Other liabilities

Primary Deficit = Fiscal Deficit – Interest Payment

Do you Know?

Investment Friendliness Index of States will launched this year for competitive cooperative federalism.

What does the Union Budget say on agriculture and how do experts analyse it?

Agriculture, which supports more than 60 per cent of India’s population, is a major part of the country’s rural economy. Finance Minister Nirmala Sitharaman Saturday said that agriculture was one of the four engines driving India’s development journey and announced several new initiatives for the sector. Some of the key initiatives are:

1. Prime Minister Dhan-Dhaanya Krishi Yojana (PMDDKY): PMDDKY will be implemented in collaboration with states, across 100 districts in its first phase. The scheme aims to increase agricultural productivity, adopt crop diversification and sustainable agriculture practices, improve post-harvest storage after harvest at the panchayat and block levels, improve irrigation facilities, and provide short-term and long-term credit.

2. National Mission on High Yielding Seeds: A National Mission on High Yielding Seeds will be launched, aimed at (1) strengthening the research ecosystem, (2) targeted development and propagation of seeds with high yield, pest resistance and climate resilience, and (3) commercial availability of more than 100 seed varieties released since July 2024.

3. Pulse Mission: The government has announced an allocation of Rs 1,000 crore for a six-year initiative called the “Pulse Mission,” aimed at boosting pulse production to achieve self-sufficiency. This initiative will focus on three types of pulses: tur (arhar), urad (mash), and masoor.

4. Makhana board for Bihar: A Makhana Board will be set up in Bihar to boost the cultivation and marketing of fox nuts. The people engaged in Makhana cultivation will be organised in FPOs. Bihar accounts for approximately 90% of India’s makhana production.

5. Rural Prosperity and Resilience’ program: A holistic, multi-sectoral ‘Rural Prosperity and Resilience’ program will be launched in collaboration with states. This initiative aims to tackle under-employment in agriculture by promoting skill development, investment, technology adoption, and revitalization of the rural economy.

6. New urea plant to come up in Assam: Finance Minister on Saturday announced the setting up of a new urea plant with an annual production capacity of 12.7 lakh tonnes (lt) at Namrup in Assam.

7. Grameen Credit Score: Finance Minister Nirmala Sitharaman also announced Grameen Credit Score, a framework to be developed by the public sector banks for the credit needs of the members of Self Help Groups (SHGs) and people in rural areas.

8. Mission for Cotton Productivity: For the benefit of cotton growing farmers a 5-year ‘Mission for Cotton Productivity’ is announced.

9. Enhancing loan limits for farmers: The finance minister also announced increasing the loan limit under the Modified Interest Subvention Scheme (MISS) from Rs 3 lakh to Rs 5 lakh.

The special focus on 100 districts to augment agri-productivity, promote sustainable farming practices and crop diversification, extending credit access through Kisan Credit Cards from Rs 3 lakh to Rs 5 lakh, starting a Pulses Mission to attain atma nirbharta in tur, moong and urad, etc., are all steps in the right direction. So is the setting up of a Makhana Board in Bihar. How far they will go in achieving their objectives remains to be seen.

While the Union Budget 2025-26 makes some progress in addressing agricultural challenges, the overall approach remains incremental rather than transformational. A paradigm shift is needed — one that moves away from subsidy-heavy interventions towards investment-driven growth, greater private sector participation, and technology-led efficiency improvements. The path to making Indian agriculture more resilient and globally competitive requires bold reforms in subsidy rationalisation, infrastructure development, and market linkages. Only then can India achieve the goal of Vikshit Bharat and position itself as an agricultural powerhouse by 2047.”

What are the major announcements for India’s MSME sector in the Union Budget, and what do experts say about it?

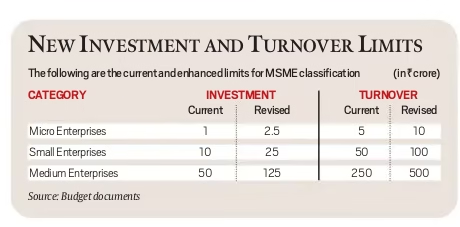

Giving new definitions for micro, small and medium enterprises (MSMEs) and announcing a slew of initiatives to help such businesses, Finance Minister Nirmala Sitharaman in her Budget speech termed them the second power engine for development. It encompasses manufacturing and services with a focus on MSMEs numbering 5.7 crore. Several key initiatives announced to address the challenges faced by the manufacturing sector, particularly for MSMEs are:

1. Definition of MSMEs widened: In her Budget speech, Finance Minister said the investment and turnover limits for classification of all MSMEs will be increased 2.5 and two times respectively.

This means the investment limit to be classified as a micro enterprise goes up to Rs 2.5 crore. For small enterprises, this limit goes up to Rs 25 crore, and for medium ones, it becomes Rs 125 crore. Similarly, the turnover limit for these classifications goes up to Rs 10 crore for micro enterprises, Rs 100 crore for small ones, and Rs 500 crore for medium enterprises.

2. Credit Guarantee Limit Increased: The Union Finance Minister also announced the enhancement of the credit guarantee cover from Rs 5 crore to Rs 10 crore for micro and small enterprises, and from Rs 10 crore to Rs 20 crore for startups. As part of the initiatives for MSMEs, she announced that a National Institute of Food Technology, Entrepreneurship and Management will be established in Bihar.

3. Customised credit cards: Customised credit cards with a limit of Rs 5 lakh were announced in the Budget for micro enterprises registered on the Udyam portal. In the first year, 10 lakh of these cards will be issued.

4. National Manufacturing Mission: The Union Finance Minister said in her Budget speech that the Central government will set up a National Manufacturing Mission for small, medium and large industries with a focus on clean tech manufacturing. The mission’s mandate will include five focus areas – ease and cost of doing business, upskilling for in-demand jobs, MSMEs, availability of technology, and quality products.

5. Scheme for First-time Entrepreneurs: A new scheme will be launched for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs. This will provide term loans up to Rs 2 crore during the next 5 years.

How does the Union Budget address investment-related challenges to stimulate economic growth?

Union Budget 2025 identifies investment as the third engine of India’s growth. It focuses on investing in people, the economy, and innovation. The following initiatives have been announced in the budget:

1. Urban Challenge Fund: The Government will establish a ₹1 lakh crore Urban Challenge Fund to support initiatives like ‘Cities as Growth Hubs,’ ‘Creative Redevelopment,’ and ‘Water & Sanitation’. The fund will cover up to 25% of viable project costs, requiring at least 50% funding from bonds, bank loans, or PPPs. ₹10,000 crore is allocated for 2025-26.

2. Public Private Partnership in Infrastructure: Each infrastructure-related ministry will come up with a 3-year pipeline of projects that can be implemented in PPP mode. States will also be encouraged to do so and can seek support from the IIPDF (India Infrastructure Project Development Fund) scheme to prepare PPP proposals.

3. FDI in Insurance Hiked: Union Finance Minister announced a significant hike in foreign direct investment (FDI) in the insurance sector — from 74% to 100% — paving the way for the entry of global insurance giants, substantial foreign investments and tough competition in the Indian market. Foreign investments will also provide much-needed capital to the Indian insurance sector, enabling insurers to offer better products and services.

4. SWAMIH Fund 2: It will be established as a blended finance facility with contribution from the Government, banks and private investors. The existing Special Window for Affordable, Mid-Income Housing (SWAMIH) scheme aims to help middle-class families who pay EMIs on loans taken for apartments, and rent on their current dwellings.

5. Nuclear Energy Mission for Viksit Bharat: A Nuclear Energy Mission for research & development of Small Modular Reactors (SMR) with an outlay of Rs. 20,000 crore will be set up. At least 5 indigenously developed SMRs will be operationalized by 2033.

6. Deep Tech Fund of Funds: Investing in innovation the budget announced a ‘Deep Tech Fund of Funds’ for next generation startups and ten thousand PM research fellowships for technological research in IITs and IISc in next 5 years.

7. Maritime Development Fund: This fund will be set up with a corpus of Rs 25,000 cr. It will support the long-term financing of the maritime industry. Aims at distributing support and promoting competition. Upto 49% GoI support, rest by ports, private sector.

8. Historic Tax Cut: The finance minister has raised the limit of income tax rebate from Rs 7 lakh to Rs 12 lakh, which essentially means that if an individual has an income of up to Rs 12 lakh, she will have zero tax liability.

How does the Union Budget align with India’s goal of becoming a global export hub?

Finance Minister Nirmala Sitharaman identified exports as a key engine for development over the coming year. To this end, she announced five initiatives:

1. Export Promotion Mission: This mission will be driven jointly by the Ministries of Commerce, MSME, and Finance. It aims to facilitate easy access to export credit, cross-border factoring support, and support to MSMEs to tackle non-tariff measures in overseas markets.

2. BharatTradeNet: A digital public infrastructure, ‘BharatTradeNet’ (BTN) for international trade will be set up as a unified platform for trade documentation and financing solutions. The BTN will complement the existing Unified Logistics Interface Platform, which allows industry players to access logistics-related datasets from various government systems.

3. Global Supply Chain Integration: Support domestic manufacturing to integrate India’s economy into global supply chains, focusing on Industry 4.0 and youth talent.

4. National Framework for Global Capability Centres: As guidance to states for promoting Global Capability Centres (GCCs) in emerging tier 2 cities. GCCs offer support to MNCs. The proposed policy aims at enhancing availability of talent and infrastructure, building-byelaw reforms, and mechanisms for industry collaboration.

5. Warehousing facility for air cargo: To facilitate the upgradation of infrastructure and warehousing for air cargo including high-value perishable horticulture produce.

Consider the following statements:

1. Revenue expenditure does not result in the creation of assets for the Government of India.

2. Capital expenditure reduces the government’s liability or increases the government’s assets.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Consider the following statements:

1. Revenue expenditure does not result in the creation of assets for the Government of India.

2. Capital expenditure reduces the government’s liability or increases the government’s assets.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by

(a) Long-standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by

(a) Long-standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

With reference to the Union Government, consider the following statements:

1. The Department of Revenue is responsible for the preparation of the Union Budget that is presented to the Parliament.

2. No amount can be withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India.

3. All the disbursements made from Public Account also need the authorization from the Parliament of India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

With reference to the Union Government, consider the following statements:

1. The Department of Revenue is responsible for the preparation of the Union Budget that is presented to the Parliament.

2. No amount can be withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India.

3. All the disbursements made from Public Account also need the authorization from the Parliament of India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit?

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit?

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

Economic Survey 2024-25 Highlights

The Economic Survey for 2024-25 was tabled by Finance Minister Nirmala Sitharaman in Parliament on Friday. The…

Analysis of the 4 engines driving the Union Budget 2025

Finance Minister Nirmala Sitharaman lists agriculture, MSMEs, investments, and exports as four key engines of…